Direct Deposit

Expecting a tax refund this year? Make sure to provide your correct account information to ensure your refund is deposited quickly and safely. Incorrect information can cause your refund to be delayed weeks or even months.

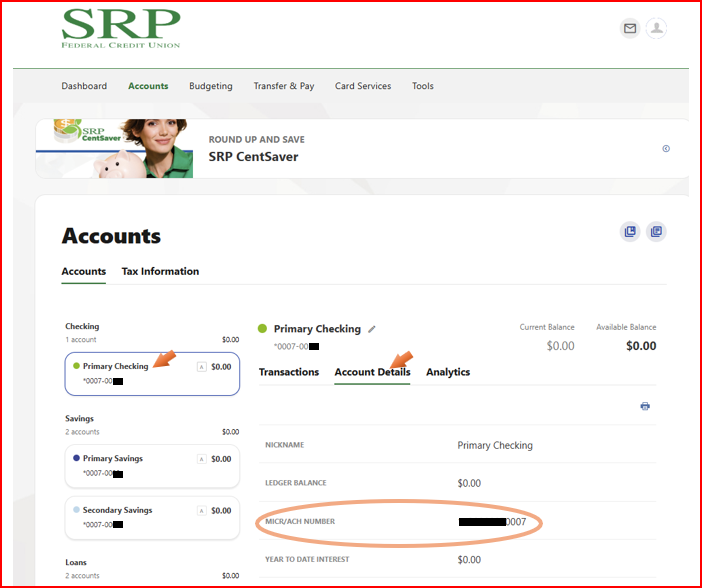

Have SRP Online or Mobile Banking?

Log on to SRP Online or SRP Mobile and click on the account (Checking, Savings, etc.) to view the history for that account. Then click "Account Details," and the account number that should be provided to set up electronic debits or credits is displayed as the “MICR/ACH number.”

SRP Online Example:

SRP Mobile Example:

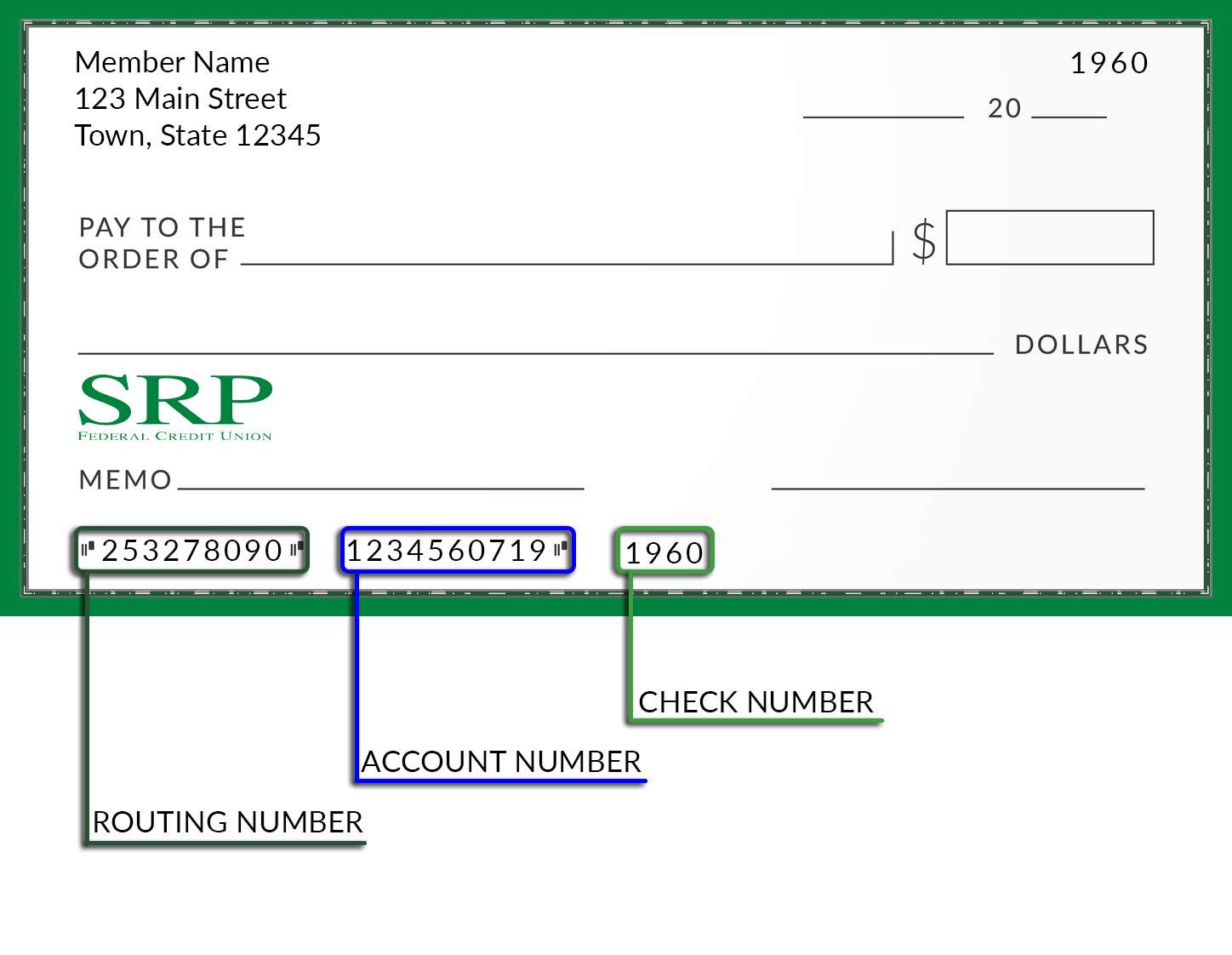

SRP Federal Credit Union's Routing Number is 253278090

Have a Check?

You can get SRP's routing number and your checking account number from the bottom of your check.

Have Questions?

Visit a Member Service Representative at any branch or call us for assistance at 803-278-4851.